What Is Tax Forgiveness: Tax Forgiveness Program

Pennsylvania Tax Forgiveness 2025: Your Ultimate Guide to Cutting State Taxes and Keeping More Money in Your Pocket Hey there, fellow Pennsylvanians , if you're grinding through another year of rising grocery bills, gas prices that won't quit, and wages that just can't keep up, I feel you. As a finance blogger who's spent years […]

Advantages tax debt help: Tax Debt services IRS

Tax Debt Help: 10 Advantages, Options, and How to Navigate IRS Programs Dealing with tax debt can feel overwhelming, but the IRS offers several programs to help taxpayers manage and resolve their obligations. Whether you're unable to pay your tax bill in full or seeking ways to reduce penalties, understanding your options is key to […]

Tax Refunds in the United States: Know the process

Do you want to know if all Americans receive a tax refund? Know more about Tax refund Introduction to Tax Refunds Every spring, millions of Americans eagerly await their tax refunds, often viewing them as a financial windfall. But what exactly is a tax refund, and why do some people receive money back from the […]

Canada Disability Benefit and Disability Tax Credit in 2025

Financial Support for Canadians with Disabilities Living with a disability in Canada can bring unique challenges, from increased medical expenses to barriers in daily activities. Fortunately, the Canadian government offers financial support programs like the Canada Disability Benefit and the Disability Tax Credit to help alleviate some of these burdens. These programs aim to provide financial relief and improve […]

USA - Federal Student Loan Instead of a Private Loan?

What is the Main Benefit of Taking Out a Federal Student Loan Instead of a Private Loan in USA? For students seeking financial relief while funding higher education, choosing between a federal student loan and private loans for students, such as a SoFi student loan, is critical. Federal education loans, offered through the Department […]

EDD Employment Development Department: How to Apply

EDD Employment Development Department: Disability Insurance, Paid Family Leave, Tax - Guide The EDD Employment Development Department serves as a lifeline for millions of Californians, offering critical services to workers, job seekers, and businesses. From financial aid during unemployment to career training and employer tax support, this state agency plays a pivotal role in fostering […]

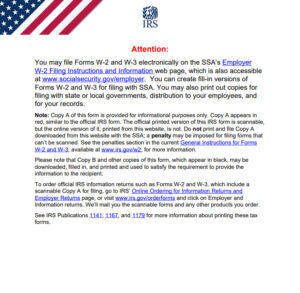

Understanding the W-2 Form: The Wage and Tax Statement USA

Know your W-2 Form, purpose, important, difference - Avoid mistake on W-2 form 2025 Every year, millions of American workers receive a W-2 form from their employers. This critical document, officially called the Wage and Tax Statement, is a cornerstone of tax season. Whether you’re new to the workforce or a seasoned taxpayer, understanding […]

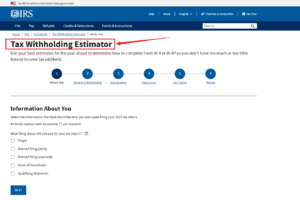

Konw Your Paycheck with the IRS Tax Withholding Tool

What Is the IRS Tax Withholding Tool? The IRS Tax Withholding Tool is an online resource offered by the Internal Revenue Service to help taxpayers calculate the ideal amount of federal tax to deduct from their earnings. Whether you’re a salaried worker, a freelancer with side income, or a retiree collecting a pension, this tool […]

USA: Tax Form 5498, IRA Guide - How to

IRS Tax Form 5498, know more information on Your Guide to IRA Contributions When it comes to managing your retirement savings, staying informed about tax documents is essential. One such document is tax form 5498, formally known as "IRA Contribution Information." Issued by the IRS, this form plays a critical role in reporting contributions, rollovers, […]

T4 Canada: How to file as an Employer in Canada

T4 Canada: File Tax T4 slip as a Canadian employee - Guidelines to follow and Mistakes to Avoid If you’re an employer or employee navigating the Canadian tax system, the term T4 Canada is something you absolutely need to understand. The T4 slip isn’t just a form, it’s a vital document that summarizes how much […]