IRS Help

IRS Help – Your Trusted Guide to Navigating the IRS

Category Description:

Welcome to the IRS Help section of TaxReliefPortal.com, your go-to resource for understanding, navigating, and resolving your interactions with the Internal Revenue Service (IRS). Whether you're facing an unexpected notice, confused about your filing status, or trying to set up a payment plan, this category is here to simplify the IRS process and reduce stress.

We break down complex tax language into clear, actionable steps so you can confidently manage your IRS obligations. Our guides cover everything from how to respond to IRS letters, set up installment agreements, file back taxes, avoid penalties, and understand your taxpayer rights.

What You’ll Find in This Section:

- How to respond to IRS notices and letters

- Step-by-step guides for contacting the IRS

- What to do if you missed a filing deadline

- Setting up IRS payment plans or hardship options

- Dealing with audits, levies, and wage garnishments

- Your rights as a taxpayer under IRS regulations

Whether you're a first-time filer or dealing with long-standing issues, we provide updated, easy-to-follow content to help you regain control. You’ll also find trusted links to official IRS tools and portals for secure account access, refund tracking, and document submission.

Our goal is to make IRS processes feel manageable, not overwhelming.

Stay informed, take action, and feel empowered with the IRS Help resources at TaxReliefPortal.com.

What Is Tax Forgiveness: Tax Forgiveness Program

Pennsylvania Tax Forgiveness 2025: Your Ultimate Guide to Cutting State Taxes and Keeping More Money in Your Pocket Hey there, fellow Pennsylvanians , if you're grinding through another year of rising grocery bills, gas prices that won't quit, and wages that just can't keep up, I feel you. As a finance blogger who's spent years […]

Advantages tax debt help: Tax Debt services IRS

Tax Debt Help: 10 Advantages, Options, and How to Navigate IRS Programs Dealing with tax debt can feel overwhelming, but the IRS offers several programs to help taxpayers manage and resolve their obligations. Whether you're unable to pay your tax bill in full or seeking ways to reduce penalties, understanding your options is key to […]

Tax Refunds in the United States: Know the process

Do you want to know if all Americans receive a tax refund? Know more about Tax refund Introduction to Tax Refunds Every spring, millions of Americans eagerly await their tax refunds, often viewing them as a financial windfall. But what exactly is a tax refund, and why do some people receive money back from the […]

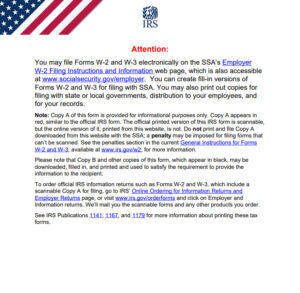

Understanding the W-2 Form: The Wage and Tax Statement USA

Know your W-2 Form, purpose, important, difference - Avoid mistake on W-2 form 2025 Every year, millions of American workers receive a W-2 form from their employers. This critical document, officially called the Wage and Tax Statement, is a cornerstone of tax season. Whether you’re new to the workforce or a seasoned taxpayer, understanding […]

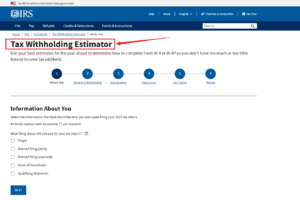

Konw Your Paycheck with the IRS Tax Withholding Tool

What Is the IRS Tax Withholding Tool? The IRS Tax Withholding Tool is an online resource offered by the Internal Revenue Service to help taxpayers calculate the ideal amount of federal tax to deduct from their earnings. Whether you’re a salaried worker, a freelancer with side income, or a retiree collecting a pension, this tool […]

USA: Tax Form 5498, IRA Guide - How to

IRS Tax Form 5498, know more information on Your Guide to IRA Contributions When it comes to managing your retirement savings, staying informed about tax documents is essential. One such document is tax form 5498, formally known as "IRA Contribution Information." Issued by the IRS, this form plays a critical role in reporting contributions, rollovers, […]