Tax Refunds

Tax Refunds – Get Your Money Back, Faster and Smarter

Welcome to the Tax Refunds section of antiquewhite-toad-536238.hostingersite.com — your complete guide to tracking, understanding, and troubleshooting your IRS tax refund.

Whether you're still waiting for your payment, curious about amended return timelines, or unsure why your refund is delayed, this section provides everything you need to know in plain English. We help you stay updated with IRS refund schedules, portal access (including "Where’s My Refund?"), and common error codes.

We also share proven tips to avoid refund delays, correct filing mistakes, and understand refund status messages — so you can confidently manage your tax refund from submission to deposit.

What You’ll Learn in This Section:

- How to track your IRS refund status

- Why your refund is delayed (and how to fix it)

- Using the IRS “Where’s My Refund?” and amended return tools

- What different refund status messages mean

- Common errors that stop refunds from processing

- How to contact the IRS about your refund

From e-filing to direct deposit, our goal is to help you get your refund quickly and without stress.

Stay informed. Stay prepared. And get what’s owed to you — faster.

Tax Refunds in the United States: Know the process

Do you want to know if all Americans receive a tax refund? Know more about Tax refund Introduction to Tax Refunds Every spring, millions of Americans eagerly await their tax refunds, often viewing them as a financial windfall. But what exactly is a tax refund, and why do some people receive money back from the […]

Canada Disability Benefit and Disability Tax Credit in 2025

Financial Support for Canadians with Disabilities Living with a disability in Canada can bring unique challenges, from increased medical expenses to barriers in daily activities. Fortunately, the Canadian government offers financial support programs like the Canada Disability Benefit and the Disability Tax Credit to help alleviate some of these burdens. These programs aim to provide financial relief and improve […]

EDD Employment Development Department: How to Apply

EDD Employment Development Department: Disability Insurance, Paid Family Leave, Tax - Guide The EDD Employment Development Department serves as a lifeline for millions of Californians, offering critical services to workers, job seekers, and businesses. From financial aid during unemployment to career training and employer tax support, this state agency plays a pivotal role in fostering […]

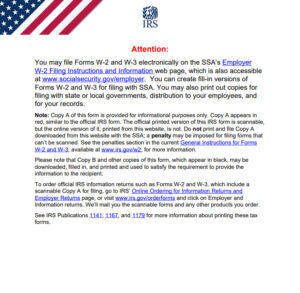

Understanding the W-2 Form: The Wage and Tax Statement USA

Know your W-2 Form, purpose, important, difference - Avoid mistake on W-2 form 2025 Every year, millions of American workers receive a W-2 form from their employers. This critical document, officially called the Wage and Tax Statement, is a cornerstone of tax season. Whether you’re new to the workforce or a seasoned taxpayer, understanding […]

USA Internal Revenue Service – Ogden Utah

US Internal Revenue Service – Ogden, Utah: Requirement, Phone number, address, Create Account The Internal Revenue Service (IRS) office in Ogden, Utah, plays a key role in helping individuals and businesses file tax returns, claim refunds, and manage their tax responsibilities. Whether you’ve received an email from the IRS, filed a form, or are planning […]