EDD Employment Development Department: How to Apply

EDD Employment Development Department: Disability Insurance, Paid Family Leave, Tax - Guide

The EDD Employment Development Department serves as a lifeline for millions of Californians, offering critical services to workers, job seekers, and businesses. From financial aid during unemployment to career training and employer tax support, this state agency plays a pivotal role in fostering economic resilience. In this page you will know more about EDD’s offerings, providing actionable insights to help you navigate its programs effectively. Whether you’re seeking unemployment benefits, exploring job opportunities, or managing payroll compliance, this article is your roadmap to leveraging the EDD Employment Development Department.

Understanding the EDD Employment Development Department

The EDD Employment Development Department is a cornerstone of California’s labor ecosystem, operating under the state’s Labor and Workforce Development Agency. Its primary goal is to empower workers and businesses by delivering financial support, career resources, and regulatory guidance. The EDD oversees a diverse array of programs, including unemployment insurance, disability benefits, family leave, job training, and tax administration, making it a one-stop hub for employment-related needs.

With a commitment to accessibility, the EDD provides services through its online platform, myEDD, as well as in-person support at America’s Job Centers across California. By modernizing its systems and expanding outreach, the department strives to meet the evolving demands of the state’s workforce.

Core Programs of the EDD Employment Development Department

The EDD operates several key initiatives to support Californians. Here’s an overview of its primary offerings:

- Unemployment Insurance (UI): Offers temporary financial assistance to workers who lose their jobs through no fault of their own, helping them stay afloat while searching for new opportunities.

- Disability Insurance (DI): Provides wage replacement for individuals unable to work due to non-work-related medical conditions or injuries.

- Paid Family Leave (PFL): Enables workers to take paid time off to care for a seriously ill loved one or bond with a newborn or adopted child.

- Workforce Development: Through partnerships with America’s Job Centers, the EDD delivers job search tools, skill-building programs, and career guidance.

- Tax Administration: Manages employment-related taxes, ensuring businesses meet state requirements.

- Labor Market Insights: Collects and shares data on job trends, wages, and industry growth to inform workers and policymakers.

These programs make the EDD Employment Development Department an essential resource for navigating California’s dynamic employment landscape.

How to Apply for Unemployment Benefits with the EDD

Applying for unemployment benefits through the EDD Employment Development Department can feel daunting, but recent updates to the process have made it more straightforward. Here’s a step-by-step guide to help you file a claim and maximize your benefits:

Step 1: Check Your Eligibility

To qualify for unemployment insurance, you must meet the following criteria:

-

Be unemployed through no fault of your own (e.g., laid off, not fired for misconduct).

-

Have earned sufficient wages during the base period (typically the first four of the last five completed calendar quarters).

-

Be actively seeking work and available to accept employment.

-

Be physically able to work.

Step 2: Gather Necessary Information

Before starting your application, collect:

-

Your Social Security Number or Alien Registration Number.

-

Details of your most recent employer, including their name, address, and dates of employment.

-

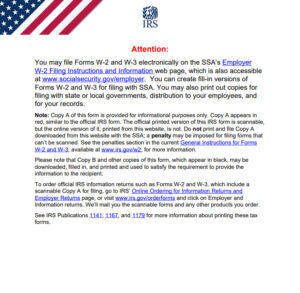

Wage information, such as pay stubs or W-2 forms.

-

Bank account details for direct deposit (optional but recommended).

Step 3: File Your Claim Online

The easiest way to apply is through the EDD Employment Development Department’s online portal, myEDD. Here’s how:

-

Visit the EDD website and create or log in to your myEDD account.

-

Select “File a New Claim” and follow the prompts to enter your personal and employment information.

-

Submit your application and note your confirmation number.

Step 4: Certify for Benefits

Every two weeks, you must certify your eligibility to continue receiving benefits. This involves:

-

Logging into myEDD.

-

Answering questions about your job search and availability.

-

Submitting the certification to avoid payment delays.

Step 5: Receive Payments

Payments are typically issued via debit card through Money Network (the EDD’s current payment contractor) or direct deposit. Ensure your account information is up to date to avoid delays.

Pro Tip: Certify promptly every two weeks to prevent interruptions in your benefits. Missing deadlines can delay payments, so set reminders or use the EDD’s online tools for notifications.

Maximizing Your Unemployment Benefits

To get the most out of your unemployment benefits:

-

Report All Wages Accurately: Underreporting or overreporting income can lead to overpayment notices or denials.

-

Appeal Denials Promptly: If your claim is denied, file an appeal within 30 days. Provide clear documentation to support your case.

-

Explore Additional Benefits: Check if you qualify for extended benefits or federal programs during economic downturns.

-

Use EDD Resources: Leverage job search tools and training programs to enhance your employability while receiving benefits.

By following these steps, you can navigate the unemployment insurance process with confidence and ensure timely financial support.

Workforce Development: Building Your Career with EDD

The EDD Employment Development Department is more than a benefits provider, it’s a gateway to career growth. Through its workforce development programs, the EDD helps Californians find meaningful employment and develop in-demand skills. Key offerings include:

- Job Search Support: Access to online job boards, resume workshops, and interview coaching.

- Training Opportunities: Programs to gain skills in high-growth sectors like technology, healthcare, and green energy.

- Career Counseling: Personalized guidance to explore career paths and set achievable goals.

- Specialized Services: Tailored support for youth, veterans, and individuals with disabilities.

America’s Job Centers, supported by the EDD, offer hands-on assistance and connect job seekers with employers. Whether you’re reentering the workforce or pivoting to a new industry, these resources can help you succeed in California’s competitive job market.

Disability Insurance and Paid Family Leave

The EDD Employment Development Department also administers vital programs like Disability Insurance (DI) and Paid Family Leave (PFL) to support workers during personal challenges.

Disability Insurance (DI)

DI provides financial assistance to workers unable to perform their jobs due to non-work-related illnesses, injuries, or pregnancy. To apply:

- Submit a claim through myEDD or by mail.

- Obtain medical certification from a licensed healthcare provider.

- File within 49 days of the onset of your disability to ensure timely processing.

Paid Family Leave (PFL)

PFL offers up to eight weeks of paid leave to care for a seriously ill family member or bond with a new child. The application process mirrors DI, requiring documentation to verify the need for leave.

Both programs are funded through payroll deductions, ensuring eligible workers have access to financial support during critical times. The EDD Employment Development Department makes these processes accessible through its online platform, simplifying applications and tracking.

Employer Support: Taxes and Compliance

For businesses, the EDD Employment Development Department is a critical partner in managing employment-related obligations. The EDD oversees:

- Unemployment Insurance Tax

- Employment Training Tax

- State Disability Insurance Tax

- Personal Income Tax Withholding

Employers must register with the EDD, file regular tax reports, and remit payments on schedule. Non-compliance can lead to penalties, audits, or legal consequences, such as liens against business assets.

The EDD provides tools like the e-Services for Employers portal and educational workshops to help businesses stay compliant. By leveraging these resources, employers can navigate tax requirements efficiently and focus on growth.

EDDNext: Making progress in Workforce Services

The EDD Employment Development Department has faced challenges, particularly during the COVID-19 pandemic, when high demand exposed system inefficiencies. In response, the EDD launched EDDNext, a $1.2 billion, multi-year initiative to overhaul its operations. Key improvements include:

- Streamlined online applications for benefits.

- Upgraded call centers for faster customer support.

- Direct deposit options for benefit payments (rolled out in 2024).

- Advanced fraud detection to protect claimants and taxpayers.

These changes aim to enhance accessibility, reduce delays, and improve the user experience, ensuring the EDD meets the needs of modern Californians.

Addressing Challenges: Fraud, Delays, and Accessibility

The EDD Employment Development Department has faced criticism, particularly for issues during the pandemic. Notable challenges include:

- Fraud: Widespread fraudulent claims drained billions from unemployment programs. The EDD has recovered significant funds and implemented stronger security measures, such as ID verification and secure debit cards.

- Delays: High claim volumes led to backlogs, delaying payments for some claimants. EDDNext aims to address this with improved technology.

- Communication Barriers: Claimants reported difficulties reaching representatives or understanding denial notices. Recent reforms, including multilingual support and clearer notifications, are improving accessibility.

Legal actions, such as settlements addressing notification issues, have prompted the EDD to enhance its processes, particularly for non-English speakers and claimants with complex cases.

Practical Tips for Engaging with the EDD

To make the most of the EDD Employment Development Department, consider these strategies:

- Use Digital Tools: The myEDD portal offers the fastest way to file claims, certify benefits, and track progress.

- Document Everything: Keep records of all interactions, including confirmation numbers and appeal submissions.

- Seek Legislative Help: If issues persist, contact your state representative’s office for assistance.

- Stay Updated: Monitor the EDD website for policy changes, fraud alerts, and new services.

- Act Promptly: File claims and certifications on time to avoid delays or overpayment issues.

By staying organized and proactive, you can navigate the EDD’s systems effectively and access the support you need.

About the EDD Employment Development Department

The EDD Employment Development Department is a vital California state agency dedicated to fostering economic stability and opportunity. Operating under the Labor and Workforce Development Agency, the EDD serves millions of workers and businesses through its core divisions: Unemployment Insurance, Disability Insurance, Paid Family Leave, Workforce Development, and Tax Administration.

Based in Sacramento, the EDD collaborates with local partners, including America’s Job Centers, to deliver services statewide. Its mission is to empower Californians by providing financial support, career resources, and regulatory guidance. For more details, explore the EDD’s official website or contact their support team.

FAQ: Answers to Common Questions About the EDD Employment Development Department

Below are real-world queries about the EDD Employment Development Department, answered to provide clarity and practical guidance.

1. How can I reach the EDD if I’m struggling with my claim?

Contact the EDD via:

- Online: Submit inquiries through the myEDD portal’s “Contact Us” feature.

- Phone: Call 1-800-300-5616 (8 a.m. to 12 p.m., Monday–Friday).

- In-Person: Visit an America’s Job Center for hands-on support.

- Legislative Assistance: Reach out to your state representative’s office for help with unresolved issues.

Tip: Call early in the morning to avoid long hold times.

2. What should I do if my unemployment claim is rejected?

If denied:

- Review the denial notice for specific reasons.

- Submit an appeal within 30 days via myEDD or mail, including supporting documents.

- Request a hearing to present your case to an impartial judge.

Act quickly to meet deadlines and improve your chances of approval.

3. How can I protect my EDD debit card from fraud?

To safeguard your benefits:

- Regularly check your Money Network card transactions.

- Use a secure PIN and never share account details.

- Report suspected fraud to Money Network or the EDD immediately.

- Switch to direct deposit for added security.

The EDD now uses secure chips and tap-to-pay features to reduce fraud risks.

4. What is EDDNext, and how will it impact users?

EDDNext is a multi-year, $1.2 billion initiative to modernize EDD services. It includes:

- User-friendly online applications.

- Improved call center response times.

- Direct deposit for faster payments.

- Enhanced fraud prevention tools.

These upgrades aim to make the EDD more efficient and accessible.

5. Are EDD services available for non-English speakers?

Yes, the EDD provides support in 15 languages, including Spanish, Mandarin, Vietnamese, and Arabic. Translated documents and interpreter services are available. Check the EDD website or call for language-specific assistance.

6. How do I certify for unemployment benefits?

To certify:

- Log into myEDD every two weeks.

- Answer questions about your job search, earnings, and availability.

- Submit your certification by the deadline to ensure timely payments.

Sign up for email or text reminders to stay on track.

7. What happens if I receive an overpayment union notice?

If overpaid:

- Review the overpayment notice for details.

- Repay the amount promptly to avoid penalties.

- File an appeal if you believe the overpayment was an error.

- Contact the EDD to arrange a repayment plan if needed.

8. How can employers ensure compliance with EDD tax rules?

Employers should:

- Register with the EDD upon hiring staff.

- Submit quarterly tax reports and payments on time.

- Use the e-Services for Employers portal for efficient reporting.

- Attend EDD workshops for compliance guidance.

Staying proactive prevents audits and penalties.

Conclusion

The EDD Employment Development Department is a vital resource for California’s workers and businesses, offering financial support, career development, and tax administration. By leveraging its online tools, staying informed about initiatives like EDDNext, and following best practices, you can maximize the benefits of EDD services. Whether you’re navigating unemployment, seeking job training, or ensuring business compliance, the EDD Employment Development Department is your partner in building a stronger financial and professional future.

Visit the EDD’s official website to explore its programs and start accessing the support you need today.