Tax Filing Deadline 2026: 10 Critical Dates to Avoid Massive Penalties

Tax Filing Deadline: 10 Crucial Dates You Must Know to Avoid Devastating Penalties

The tax filing deadline is a critical milestone that every taxpayer should mark on their calendar right away. I have seen countless individuals stress over last-minute filings, and I always advise you to plan to avoid unnecessary headaches. We know from years of experience that understanding the tax filing deadline can save you money and time. You might think taxes are complicated, but breaking down the tax filing deadline into manageable parts makes it straightforward.

As a seasoned tax enthusiast, I recommend starting your preparation early to meet the tax filing deadline without issues.

Introduction to Tax Filing Deadlines

In this section, we'll dive into the basics of what the tax filing deadline means for you as an individual. I often tell my readers that the tax filing deadline isn't just a date; it's your opportunity to stay compliant and potentially claim refunds. We believe that knowing the tax filing deadline helps you organize your financial documents effectively.

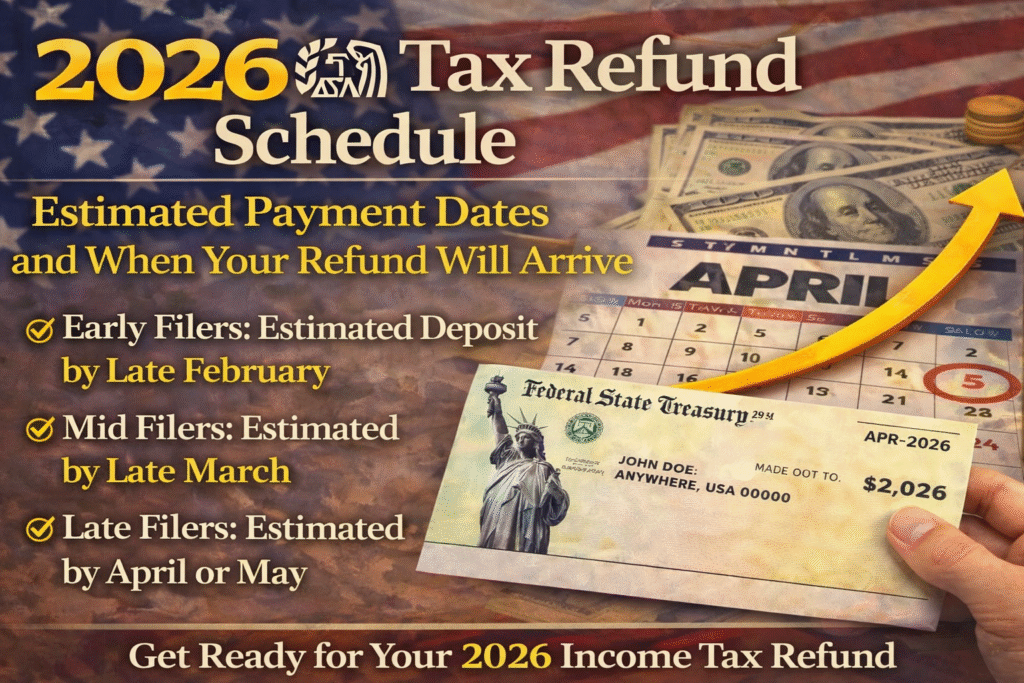

You can avoid penalties by familiarizing yourself with the primary tax filing deadline for most Americans. From my perspective, the tax filing deadline serves as a reminder to review your year's finances thoroughly. The official tax filing deadline for 2025 returns is April 15, 2026, for calendar-year filers. I suggest you check if your fiscal year differs, as that could shift your tax filing deadline. We have helped many clients navigate these variations, ensuring they meet their specific tax filing deadlines.

You should note that if the tax filing deadline falls on a weekend or holiday, it moves to the next business day. As someone who has dealt with tax seasons for years, I know the importance of this adjustment to the tax filing deadline.

The Main Tax Filing Deadline: April 15, 2026

Here, we'll explore the core date that defines the tax filing deadline for most people. I always emphasize to you that April 15, 2026, is the day to file your 2025 federal income tax return. We recommend gathering all W-2s and 1099s well before this tax filing deadline. You will want to pay any taxes owed by this tax filing deadline to prevent interest accrual.

In my experience, missing the tax filing deadline can lead to a 5% monthly penalty on unpaid taxes. The tax filing deadline also coincides with the first estimated tax payment for 2026. I urge you to use tools like the IRS withholding estimator before the tax filing deadline.

We find that electronic filing speeds up processing around the tax filing deadline. You can expect refunds faster if you e-file by the tax filing deadline. As an expert in this area, I know that states may have their own tax filing deadline aligned with the federal.

For more on state taxes, check our internal guide at Tax Refunds in the United States: Know the process

Requesting an Extension for Your Tax Filing Deadline

This part covers how to extend your tax filing deadline if needed. I have advised many who benefit from extending the tax filing deadline to October 15, 2026. We stress that an extension is for filing, not paying, settle debts by the original tax filing deadline.

You must file Form 4868 by April 15 to push your tax filing deadline. From years of observation, I see that this gives breathing room without late-filing penalties if you pay on time.

The tax filing deadline extension is automatic upon approval. I recommend using IRS Free File for your extension request before the tax filing deadline. We have seen clients avoid stress by planning for this adjusted tax filing deadline.

You should estimate and pay any owed amount to minimize penalties post-tax filing deadline. As a practical tip, I suggest tracking your extension confirmation for the new tax filing deadline.

Explore our internal resource on tax forms at USA: Tax Form 5498, IRA Guide - How to for Form 4868 details.

Estimated Tax Payments and Their Deadlines

Let's detail the quarterly payments that tie into the broader tax filing deadline.

- I constantly remind self-employed individuals that estimated tax deadlines are crucial alongside the main tax filing deadline.

- We know the fourth quarter 2025 estimated payment is due January 15, 2026.

- You need to make these to avoid underpayment penalties before the tax filing deadline.

- In my professional view, the first 2026 estimated tax is due on the tax filing deadline of April 15.

- The second is June 15, 2026, which follows the tax filing deadline.

- I advise calculating your estimated taxes accurately to meet these deadlines.

- We often see people use Form 1040-ES for these payments after the tax filing deadline.

- You can pay online via IRS Direct Pay to hit these estimated tax deadlines.

- As someone experienced, I know missing them can add 0.5% monthly interest.

For tips on calculations, see our internal article at Tax Relief Eligibility Calculator.

Penalties for Missing the Tax Filing Deadline

Understanding consequences is key; here, we break down penalties related to the tax filing deadline. I have witnessed how late filing can cost 5% per month on the unpaid balance after the tax filing deadline.

- We urge you to pay at least 90% of owed taxes by the tax filing deadline to reduce penalties.

- You might face a minimum penalty if your return is over 60 days past the tax filing deadline.

- From my insights, the failure-to-pay penalty is 0.5% monthly, starting from the tax filing deadline.

- The underpayment penalty for estimated taxes can apply if you miss quarterly deadlines before or after the tax filing deadline.

- I suggest setting reminders to avoid these costs tied to the tax filing deadline.

- We have strategies to minimize penalties if you're late on the tax filing deadline.

- You can request penalty abatement if you have reasonable cause after the post-tax filing deadline.

As a guide, I know timely extensions help dodge some penalties around the tax filing deadline.

When Are Taxes Due in 2026? Key IRS Deadlines for Your Money

Special Cases Affecting the Tax Filing Deadline

Special situations can alter your tax filing deadline; let's examine them. I often share with military personnel that combat zone service extends the tax filing deadline by 180 days.

- We recognize that living abroad might give you until June 15 for the tax filing deadline.

- You should notify the IRS if in a disaster area, as it could postpone your tax filing deadline.

- In my experience, presidentially declared disasters can extend the tax filing deadline up to a year.

- The tax filing deadline for fiscal year filers is the 15th of the fourth month after year-end.

- I recommend checking IRS announcements for any shifts in the tax filing deadline due to events.

- We help clients in these scenarios to adjust their tax filing deadline accordingly.

- You can find relief options on the official IRS site for modified tax filing deadlines.

- As an authority, I know these extensions also apply to payments in special cases.

For more on disaster relief, visit our internal link at Advantages tax debt help: Tax Debt services IRS.

Tax Filing Deadline for Businesses and Other Entities

While focused on individuals, businesses have related tax filing deadlines. I tell business owners that partnership returns are due March 15, before the individual tax filing deadline.

- We note S-corp deadlines are also March 15, impacting personal tax filing deadlines.

- You might need to align your business and personal tax filing deadlines.

- From years of advice, I see corporations have April 15 as their tax filing deadline too.

- The employer tax deposits have semiweekly or monthly rules around the tax filing deadline.

- I suggest using the IRS tax calendar for all business-related tax filing deadlines.

- We have seen penalties for late business filings be per partner or shareholder.

- You can extend business returns, similar to individual tax filing deadlines.

As a tip, I know coordinating these prevents surprises at your personal tax filing deadline.

Preparing Early for the Tax Filing Deadline

Preparation tips to meet your tax filing deadline smoothly. I always encourage organizing receipts months before the tax filing deadline.

- We believe using tax software can streamline meeting the tax filing deadline.

- You should review last year's return to anticipate changes by the tax filing deadline.

- In my view, consulting a professional early ensures you hit the tax filing deadline.

- The filing season opens January 26, 2026, ahead of the tax filing deadline.

- I recommend e-filing for faster refunds post-tax filing deadline.

- We find that tracking deductions maximizes benefits before the tax filing deadline.

- You can use IRS online tools to prepare for the tax filing deadline.

As experienced advisors, we know early action reduces errors on the tax filing deadline.

Common Mistakes Around the Tax Filing Deadline

Avoid pitfalls that many face with the tax filing deadline. I have seen people forget to pay with their extension, missing the effective tax filing deadline.

- We warn against underestimating owed taxes by the tax filing deadline.

- You might overlook estimated payments, leading to penalties after the tax filing deadline.

- From my observations, not updating address can delay refunds past the tax filing deadline.

- The mistake of filing late without reason racks up fees from the tax filing deadline.

- I advise double-checking math to avoid amendments after the tax filing deadline.

- We often correct clients who miss dependent claims before the tax filing deadline.

- You should verify all income sources to comply by the tax filing deadline.

As a pro, I know rushing on the tax filing deadline causes errors.

Resources and Tools for Managing Tax Filing Deadlines

Essential resources to handle your tax filing deadline.

- I highly recommend the IRS website for official tax filing deadline info. Visit https://www.irs.gov/filing/individuals/when-to-file.

- We suggest TurboTax for guidance on tax filing deadlines. Check turbotax.intuit.com/tax-tips.

- You can use the IRS Tax Calendar app to track the tax filing deadline.

- In my toolkit, Free File is great for extensions before the tax filing deadline.

- The NerdWallet guide offers insights into estimated tax deadlines related to the tax filing deadline.

- I suggest bookmarking these for year-round tax filing deadline awareness.

- You will find community forums helpful for questions on the tax filing deadline.

As a final note, I know staying informed prevents issues with the tax filing deadline.

IRS Filing Timeline 2026: Critical February 28 Deadline Could ...

10 Crucial Tax Dates to Remember

- January 15, 2026: Final estimated tax payment for 2025.

- January 26, 2026: IRS filing season opens.

- April 15, 2026: Main tax filing deadline for 2025 returns and first 2026 estimated payment.

- June 15, 2026: Second 2026 estimated tax payment.

- September 15, 2026: Third 2026 estimated tax payment.

- October 15, 2026: Extended tax filing deadline.

- January 15, 2027: Final 2026 estimated tax payment.

- March 2, 2026: Alternative date for some estimated tax exemptions.

- February 2, 2026: Deadline for certain unfiled returns.

- Various: Disaster or military extensions as announced.

I compiled this list based on reliable sources to help you with the tax filing deadline.

We think numbering them makes tracking the tax filing deadline easier. You can add these to your calendar to stay ahead of each tax filing deadline.

FAQ

What is the primary tax filing deadline in 2026?

The primary tax filing deadline is April 15, 2026, for filing 2025 returns and paying owed taxes.

Can I extend my tax filing deadline?

Yes, you can extend to October 15, 2026, by filing Form 4868, but payments are due by April 15.

What are the estimated tax payment deadlines for 2026?

They are April 15, June 15, September 15, 2026, and January 15, 2027.

What penalties apply if I miss the tax filing deadline?

Late filing incurs 5% per month, late payment 0.5% per month, plus interest.

Where can I find official information on the tax filing deadline?

Visit the IRS website at https://www.irs.gov for the most accurate tax filing deadline details.

Do special circumstances change the tax filing deadline?

Yes, military service or disasters can extend your tax filing deadline; check IRS notices.

How do I pay taxes by the tax filing deadline?

Use IRS Direct Pay, credit card, or mail a check by the tax filing deadline.

What if I can't pay by the tax filing deadline?

Set up an installment agreement with the IRS to manage payments after the tax filing deadline.

Is the tax filing deadline the same for businesses?

No, partnerships and S-corps have March 15, but individuals align with April 15.

Can I file early before the tax filing deadline?

Yes, the season opens January 26, 2026, allowing filings before the tax filing deadline.